Finance Transformation - On Premises vs Cloud

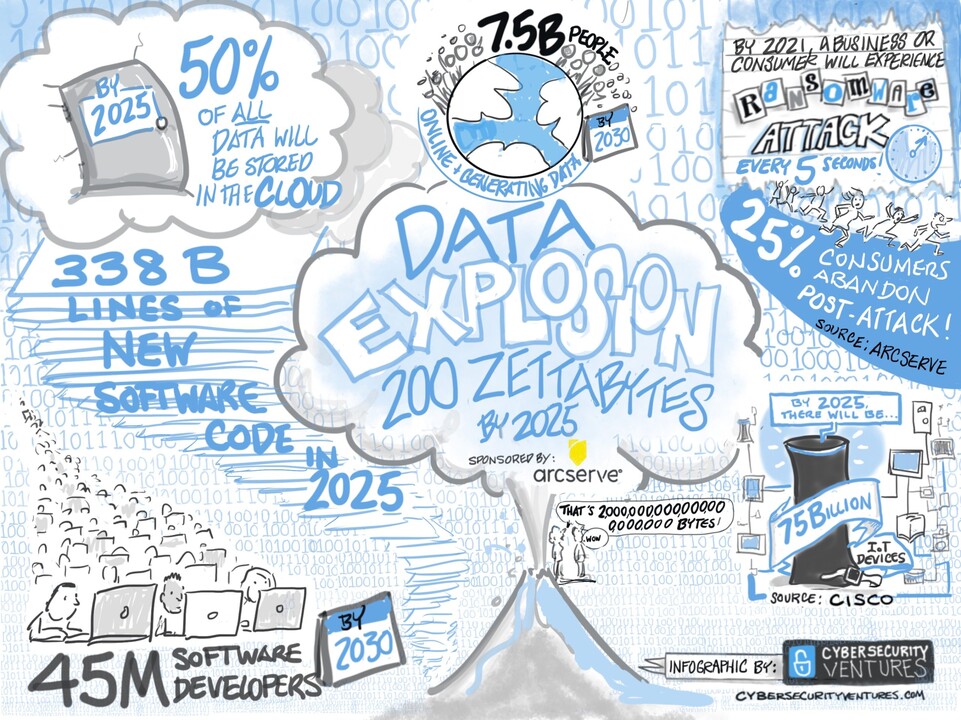

As part of the Finance Transformation journey many organisations across the globe are assessing/assessed their software inventory, to plan and future proof their technology stack. One of the important considerations in this journey for Finance Directors is to evaluate cloud options for performance management tools(Volume of data in cloud data centres will exceed 100 zettabytes by 2025). Although there are multiple cloud offerings, I will be discussing on SaaS (Software as Service) vs On-premises pros and cons which needs to be considered before making the decision.

Cost

Let’s imagine XYZ company which has on-premises performance management software. The infrastructure and maintenance of the software is undertaken by the company’s IT function and the software itself is used predominantly by the finance community. There is direct cost and indirect cost involved in this set up. As a firm, XYZ’s IT function have a cost to provision and maintain the infrastructure (Hardware Cost) and since this software helps the finance community of that organisation there is a cross charge between IT and Finance for support of this infrastructure (which involves hyper care & upgrades). This accumulates over time as capital expenditure.

In SaaS, this cost can be eliminated (no hardware cost), as maintenance and support are taken care by the vendor support team. Over time, this option becomes substantial and is viewed as cost effective investment which has greater ROI for business.

Upgrades

Any software technology goes through Continuous Development – this means new features, enhancements, and fixing bugs.

For an on-premises customer, there will be an IT cost for upgrades and maintenance of software. Because of this cost, any new features of software never sees the light of the day (IT mantra – if it isn’t broken, don’t fix it). Software Upgrades (unless for an end of support version) are always down in IT priority. This usually leads to using a (~) decade old software and the growing frustration of the business users.

In SaaS, upgrades are maintained by the vendor support team and the clients can choose to opt in. This allows some organisation to follow their IT protocol of being couple of versions behind the current version of the technology. In return, this enhances user experience and creates more buy-in. With latest technology (Containers and Kubernetes) there is no downtime on upgrades, and it is seamless transformation.

Compliance

In my previous roles working for on-premises customers – every year there is at least 2-3 weeks of work to understand the licensing agreements and make sure the customer is compliant with vendor's enterprise agreement. Usually, there is a check on number of administrators and users based on the licensing agreements. Often times, clients have had the software for a long time and the re-occurring changes in the entitlements during the renewals along the years makes compliance even more hard and daunting.

In SaaS offering, this is eliminated by simple licensing models during the time of purchase and reviewed during renewals.

Governance

Lately, there has been software vulnerabilities (Apace Log4j and Spring4shell) exposed by hackers which needed immediate attention for on-premises and cloud customers.

For On-premises clients, this will mean the IT team should drop their current work to find a solution for vulnerabilities and patch the software. Moreover, the cost to develop expertise in this area with highly trained security technical resources is huge.

SaaS customers have the luxury to not worry as this is taken care by the vendor and the vendor follow industry governance standards to patch against vulnerabilities.

On the other side, there are also on-premises customers who have strong in-house team of developers and platform owners who take care of finance related technology of the organisation diligently and maintain latest versioning. However, when it comes to cost saving, it is a no-brainer to move to cloud offering. Furthermore, the Finance users can concentrate on the actual work and leave the boring technical back end for the experts whilst lowering cost.

Therefore, if you are an existing on-premises IBM Planning Analytics (TM1) customer aiming for finance transformation journey who would like to take advantage on cloud offerings and don’t know where to begin? please start a conversation with your IBM representative.

The views on this article belong to Akram and does not represent Akram’s employer.

Knowledge Orchestrator

1yGreat article thanks Akram. In addition to this, I would add that the user experience is almost always better, particularly for the 'non core' business applications. A few years ago my company experienced a major datacenter outage and it took two weeks before by IBM Planning Analytics instance became a priority for recovery. As a user, I would always prefer to be somebody's external customer than battle for internal resources.